georgia property tax exemption codes

In order to qualify for one of the exemptions the property must not be used for the purpose of. Provided in Georgia Constitution and Georgia Code Bases for exemption.

The owner of the property must be a non-profit organization a copy of your IRS 501c3 award letter will be requested.

. All tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value. You may qualify for the S1 exemption. Applies to all Fulton ad valorem levies in the amount of 4000.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. The GDVS can only verify the status of a. Georgia counties rely on the property tax to sustain governmental services.

Items of personal property used in the home if not held for sale rental or other commercial use. Totally Disabled Code L12 Under Age 65You must be 100 disabled documented by two doctors letters or one doctors letter and Social Security award letter. I am 65 years old or older.

All applications for Special Qualification Exemptions must be made in person in the Tax Commissioners Office due to the documentation that is required. The value of the property in excess of this exemption remains taxable. Download fax print or fill online Form ST-5 more subscribe now.

Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16. STANDARD Codes Qualifications Exemptions AGE. Homestead Exemption Codes - Schneider Corp.

Part 1 - Tax Exemptions. 1 A Except as provided in this paragraph all public property. 8 rows Any Georgia resident can be granted a 2000 exemption from county and school taxes.

48-5-48 Local School Homestead. Search For Title Tax Pre-Foreclosure Info Today. The homestead freeze is the exemption equal to any increase of.

Ad Complete Tax Forms Online or Print Official Tax Documents. Any of these codes may also have an F which signifies the homestead freeze S1F L1F. Georgia exempts a property owner from paying property tax on.

Your cars must be registered in Augusta-Richmond County and you must not claim homestead on any other property. You may qualify for the H2A or S4 exemption. Ad Be Your Own Property Detective.

Basic Homestead Basic Homestead Exemption coded L1. Homestead Exemption Codes - Fulton County Board of Assessors. To be eligible for this exemption you must meet the following requirements.

Any qualifying disabled veteran may be granted an exemption of 81080 from paying property taxes for state county municipal and school purposes. GA Code 48-5-41 2016 a The following property shall be exempt from all ad valorem property taxes in this state. Property 5 days ago Qualifications Exemptions Exemptions For Homestead Codes S1B S5B and SSB.

Your Georgia taxable net income for the preceding taxable year cannot exceed 10000. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. Must be age 65 on or before January 1.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. The general rule for all exemptions is. COOPF 0 COOP - Fulton County S1 Regular Homestead HF01 2000 Fulton Homestead Reg S1 Regular Homestead HF01U1 2000 HF01 UE1 S1 Regular Homestead HF01U2 2000 HF01 UE2 S1 Regular Homestead HF01U3 2000 HF01 UE3 S1 Regular.

A homestead exemption can give you tax breaks on what you pay. Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. This exemption provides tax relief of approximately 60 - 85 dollars per tax year.

Property exempt from taxation. Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. 1 The property is committed to and held in good faith for an exempt use.

Each Georgia home that is occupied and used as the primary residence of the owner may be granted a 2000 deduction. This exemption is extended to the un-remarried surviving spouse or minor children. B No public real property which is owned by a political subdivision of this state and which is situated outside.

4000 FULTON COUNTY EXEMPTION. B in the homestead code denotes local floating homestead. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter.

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description. The Regular Homestead Exemption is a reduction of 2000 off the assessed value for School taxes and 6000 for County taxes. The L1 basic Homestead Exemption is available for application by any homeowner meeting the criteria above.

The following table describes each of the different homestead exemptions and the deducted amount from the assessed value of the property. These exemptions are based on age and income. Property taxes are the cornerstone of local neighborhood budgets.

I am 62 to 64 years old. State and federal government websites often end in gov. You may qualify for the S3 exemption.

What types of real property have been granted an exemption from Georgias property tax. Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office. While the state sets a minimal property tax rate each county and municipality sets its own rate.

For information in regard to the Exemptions listed below please call the Tax Assessors office at 770-288-7999 opt. Theyre a funding anchor for public services in support of cities schools and special districts including sewage treatment plants public safety services transportation and more. The exemption is 50000 off.

Use of property Owner of property. The following list sets forth the property tax exemptions that are most likely to be used by Georgia nonprofit organizations. The Understanding Homestead Exemption Handout pdf can be downloaded.

Introduction For example property owned by the following. The following Exemptions must be filed at the Tax Assessors Office. The Georgia Code grants several exemptions from property tax.

Understanding Appealing Fulton County Property Tax Assessment Workshop Youtube

Property Tax In Portugal Services Advocate Abroad

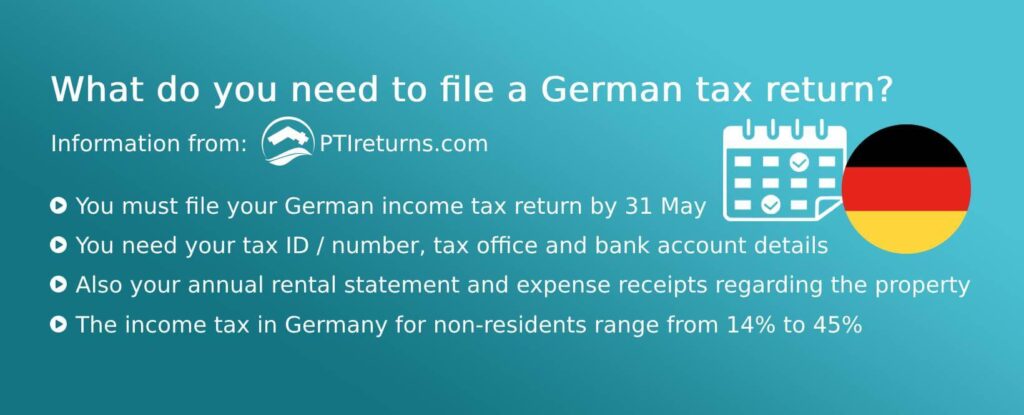

German Tax Advice For Smart Foreign Real Estate Investors Owners

Immovable Property Acca Global

German Tax Advice For Smart Foreign Real Estate Investors Owners

Personal Property Tax Portsmouth Va

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Qualifying Trusts For Property Tax Homestead Exemption Sprouse Shrader Smith

The Cook County Property Tax System Cook County Assessor S Office

Immovable Property Acca Global

German Tax Advice For Smart Foreign Real Estate Investors Owners

Self Directed Ira Vs Solo 401k Which Is Best For Real Estate Investors Real Estate Investor 401k Investment Services